- Babe

- Posts

- trading like a degenerate (affectionately): discovering limit orders and other adult things

trading like a degenerate (affectionately): discovering limit orders and other adult things

why strategy inside of chaos feels like home, and how selling half your bag at the top, then immediately buying three more bags is a vibe (not advice)

In this week’s issue:

gm and welcome to issue 28—thanks for being here. 🏴☠️

As per usual, def go follow Babe over on insta, Farcaster (the purple app), and The Base App @winberry.

Last week I touched on super apps (yes, I’m now in the beta version of TBA—thank you, Jesse!) and the crypto moves that are looking like a web3 gateway drug. If you missed all that ish, you can find it right here.

This week I'm going to try and show my process (in public, as always) around executing my first real trading strategy. This includes selling half my Pengu bag at the top, reinvesting those gains into three other coins, and discovering that Coinbase's "advanced mode" isn't nearly as confusing as it looks.

As someone who gets genuinely flustered by basic restaurant math and has to concentrate really hard when carrying numbers, I’m really proud of the fact that I managed to set limit orders and execute a diversified trading plan. I mean it—because if fifteen year old me, living in a financially illiterate and insecure household of artists, thinkers, and tinkerers could read that last sentence, she’d be fucking aghast.

Which means, you can probably do it too.

Let's get into it.

lol exactly

Hodl Me Tender: 🔥 Web3 + AI Jobs of the Week

Looking for your next move in (or into) web3, crypto, or AI? Here are some fire openings for this week, all remote, all posted in the past four days:

Risk Labs needs a Community Manager (ask them for more 💰!)

They (Risk Labs) is looking for a Frontend Lead 🔥

Ethereum Foundation needs a DeFi Specialist to join their team 🔥💰

Logos needs a Campaign Director

BOB is looking for a Social Media & Content Manager

Ether.fi is on the hunt for a Product Designer (hybrid w/ relocation)

Every wants to find a Social Media Person 🔥

BitMEX needs a KOL Growth Marketer (Europe) —is it you?

CoinLedger is looking for a Software Engineer 🔥

Want to be the Senior Product Manager at Risk Labs ? Get it. 🔥💰

Want to see your company's job listed here? Reply to this email and lmk.

***quick note from today’s sponsor (these ads are cheesy, I know—but I fully vet the newsletters and damn a girl gotta get paid)***

Want to get the most out of ChatGPT?

ChatGPT is a superpower if you know how to use it correctly.

Discover how HubSpot's guide to AI can elevate both your productivity and creativity to get more things done.

Learn to automate tasks, enhance decision-making, and foster innovation with the power of AI.

***back to my shit***

Touch Grass: When Something Feels Hard But It’s Actually Not (you’ve just never done it before)

In mid-February of this year, on a whim and as an experiment and because they’re cute, I bought $40 worth of Pengu, the Pudgy Penguins’ memecoin. Fast forward to the end of July and that $40 is now $160. A 300% increase. This, as I know from reading and watching and absorbing, is what memecoins do—dip and rip, over and over again.

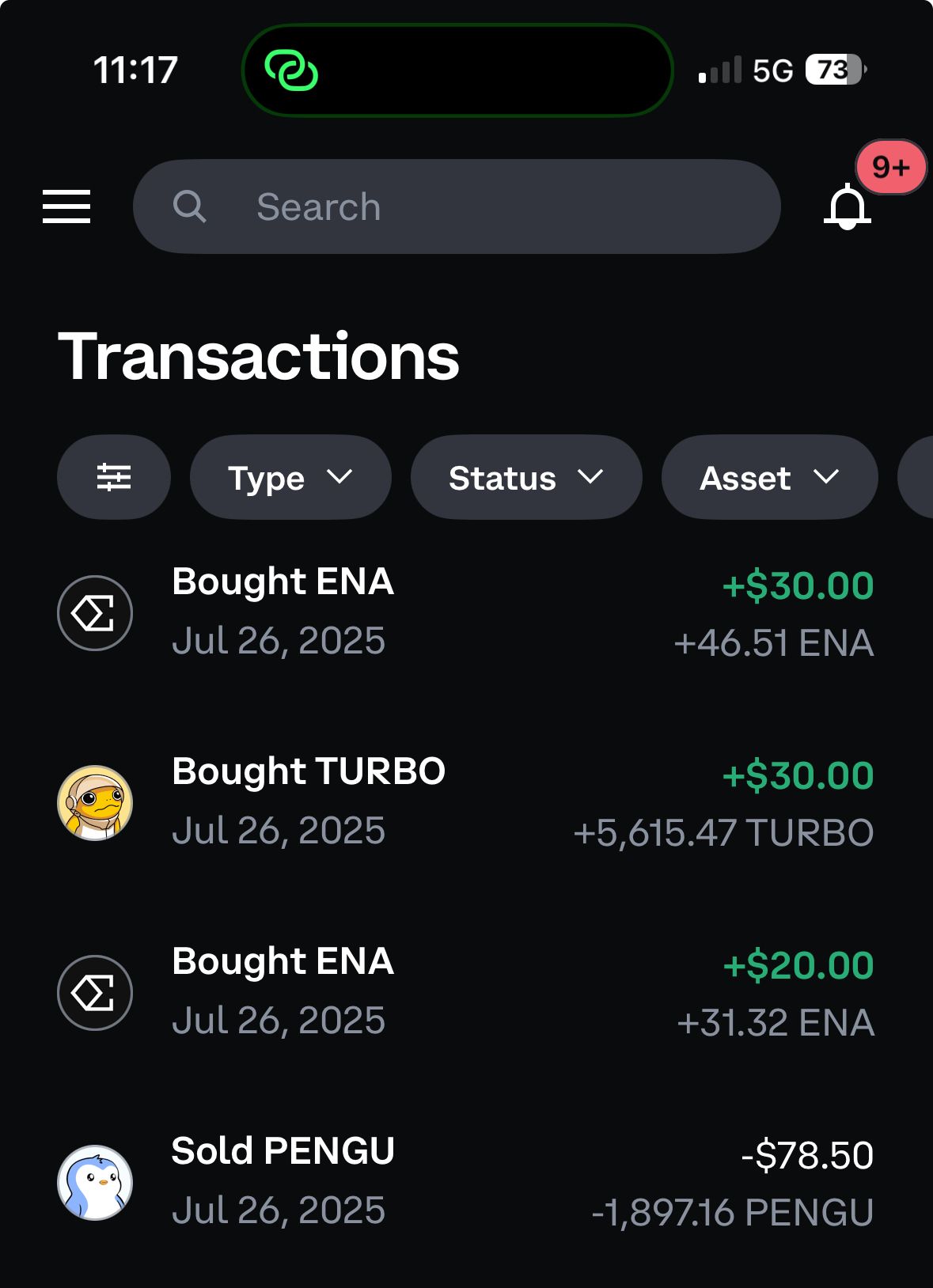

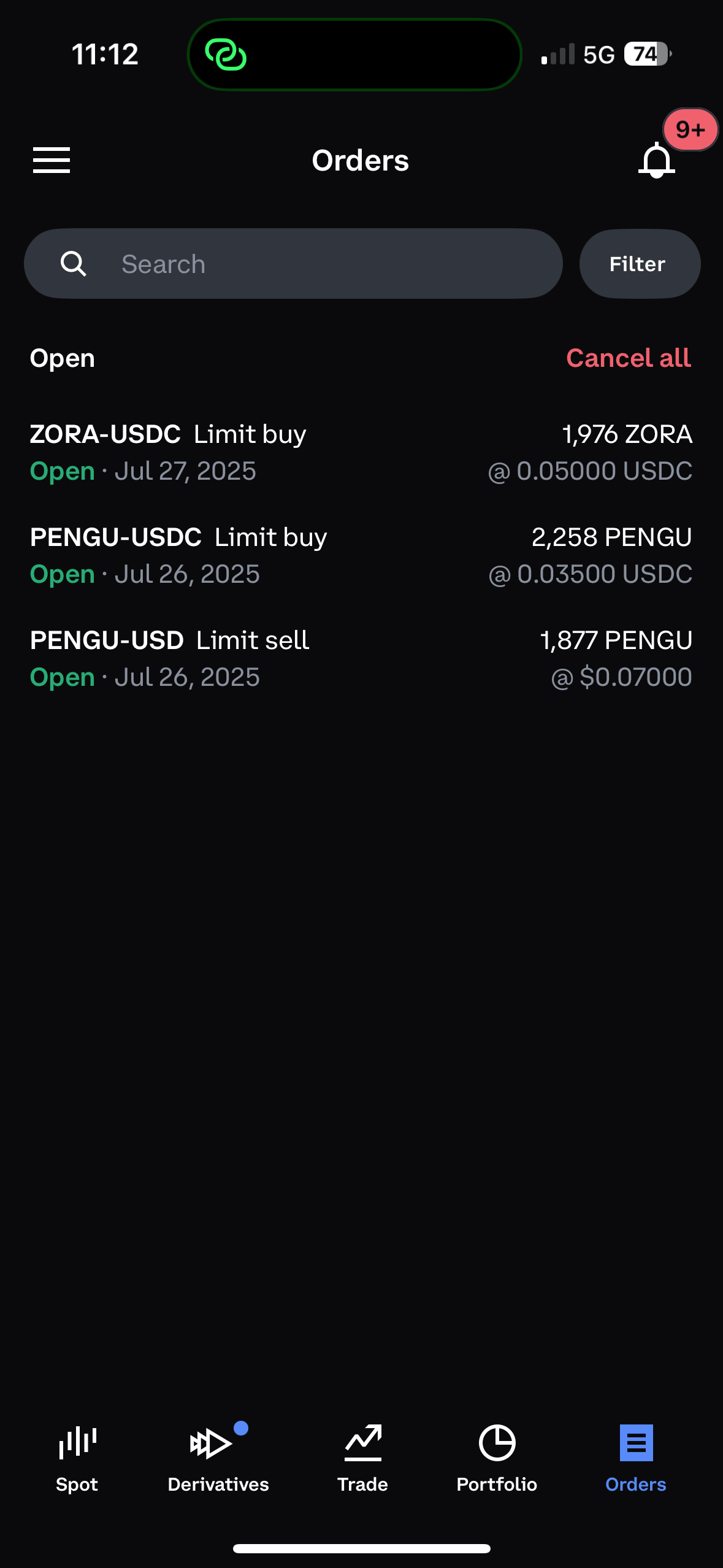

As another experiment, I decided to sell half my Pengu and use the $80 profit to buy three (new to me) coins, as well as set up two (new to me) things: a limit buy order and a limit sell order using Coinbase Advanced.

I accidentally bought ENA twice, and then bought $30 worth of DEGEN via my Farcaster wallet (don’t ask why)

Smart or not, here’s how my experiment turned into a baby trading strategy:

When Pengu hit what felt like peak momentum, I made a deliberate choice: sell half, lock in profits, let the rest ride. Classic risk management, even if I had to ask Chat "what does taking profits actually mean" at least three times.

In selling, I turned $40 worth of penguin coins into $80 of actual USDC—a clean 2x that suddenly made this whole crypto thing feel less like gambling and more like... strategy?

Instead of sitting on those gains like a responsible adult, I asked Chat if and how I should reinvest them. After some back and forth, that $80 went into three different coins—Ethena, Turbo, and Degen—because diversification, baby. (Or because I've developed a shopping addiction but for cryptocurrencies. Both can be true.)

The advanced mode revelation (or: just because something appears confusing doesn’t mean it is)

Because Chat mentioned Coinbase’s “Advanced Mode”—which “provides tools like interactive charts, order books, and a lower-priced maker-taker fee structure,” I decided to get fancy and try it. Upon first glance, advanced mode looks confusing as fuck (the UX is for sure for people who “get math” and like charts with numbers in them), but really, in using it to create simple buy/sell orders, it wasn’t confusing at all.

Sure, there’s a bunch of “advanced mode” terminology I still need to look up. But the main differences kinda just have to do with color palettes (these mean so much to our brains!), level of detail, and features. You actually get more in the advanced mode, while paying less to make and take orders. (In regs mode, you’re paying a little more for slightly easier UX and friendlier design, which… fair. I digress.)

Coinbase regs mode |  Coinbase “advanced mode” |

Back to Pengu and setting up orders in advanced mode.

I set a limit sell order on my remaining Pengu—basically telling the app if this hits X price, sell it automatically so I don't have to stare at charts all day like a degenerate. Then, because I'm apparently now a person who does this, I set a limit buy order to automatically purchase more Pengu if it dipped to a certain price.

Reader, I tell you—I felt like a Wall Street person. A Wall Street person who asks Chat to remind her what a limit order is before placing one, but still.

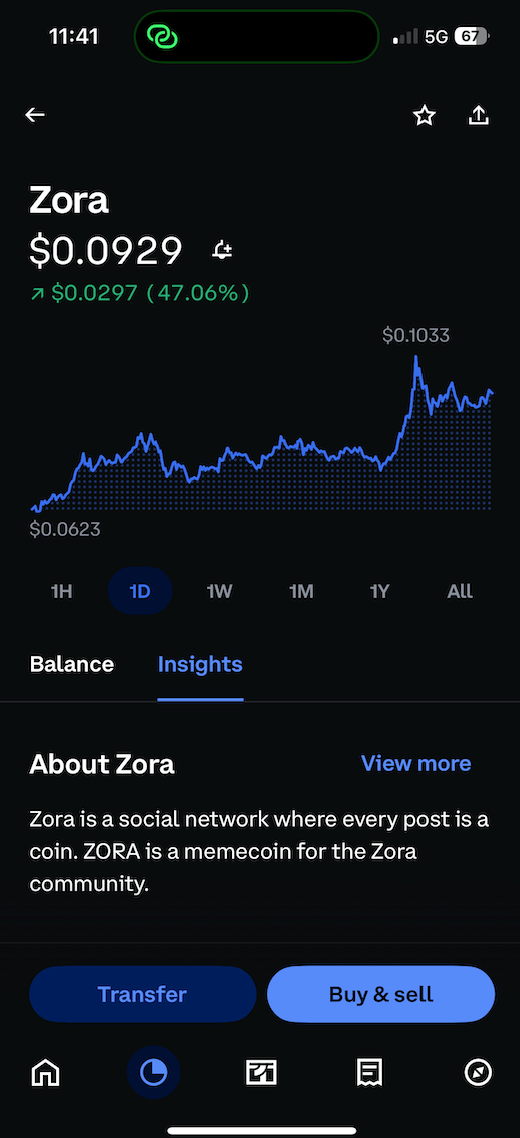

I also sold a bit of Zora (because it’s also at a peak), but mostly am hodling and setting a buy order because I believe in the trajectory and vision of the Zora creator economy.

When being math dumb becomes a superpower

My anecdotally-informed take on crypto trading? Being anxious about numbers might actually make you better at it. While the confident people are yolo’ing their kids' college funds into dog coins, I'm over here triple-checking every decimal point and conversing with Chat and reading and setting stop-losses because I assume I'm definitely going to fuck something up.

Whew.

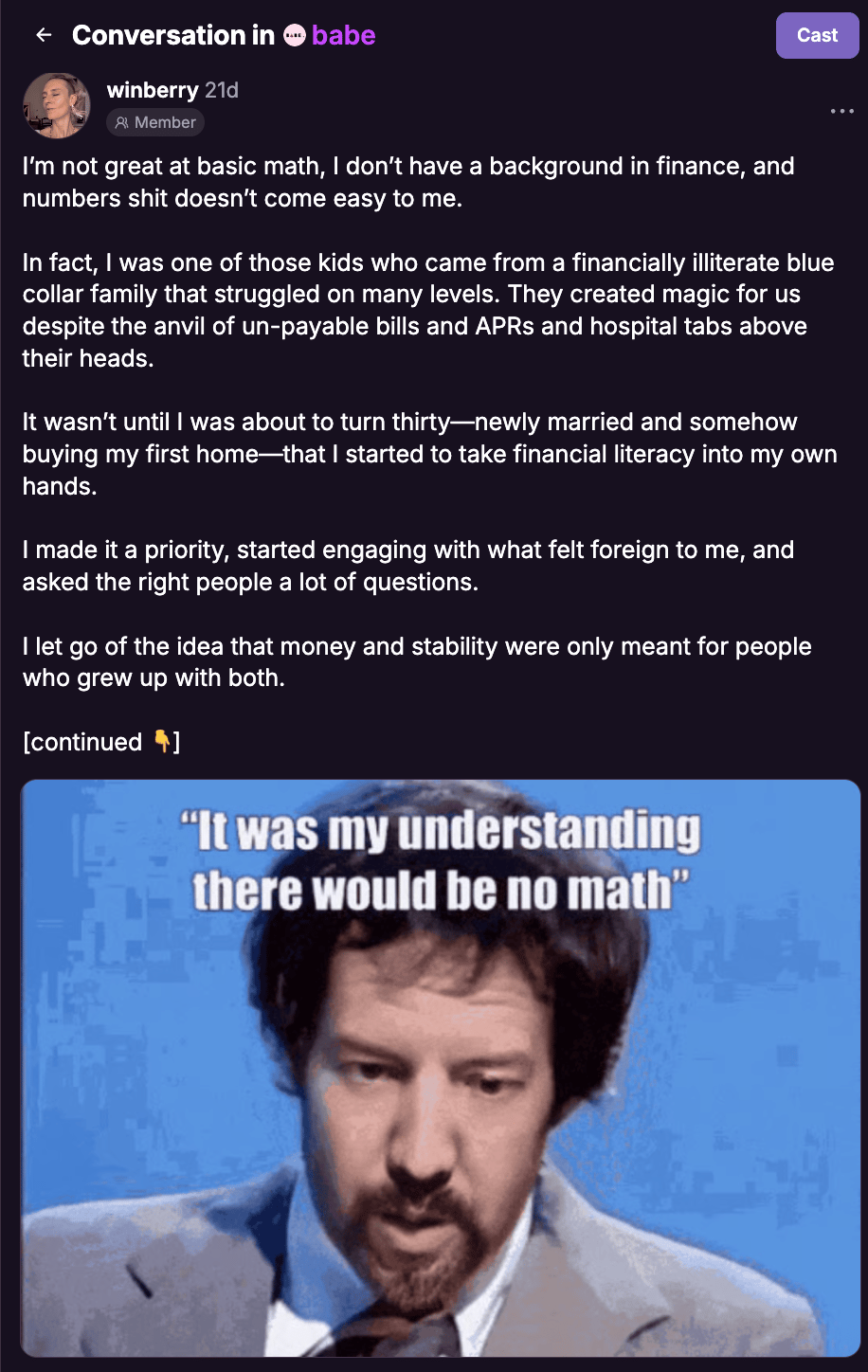

This reminds me—three weeks ago on Farcaster, I wrote about growing up financially illiterate and eventually figuring out how to dig my parents out of massive debt and, eventually, buy them a house. The same skills that got me there—asking questions, admitting ignorance, pushing through the tunnels of confusion an setback—are what's helping me navigate this ridiculous landscape of penguin coins and limit orders.

Learning in public is pretty fucking sweet

Every time I scroll through Farcaster (and now TBA), there’s always multiple someones spraying about how "this is the top" or "welcome to degen mode." I think these someones have been mainstays of crypto Twitter since day one—both alarmist hype-filled, and also an extension of the ego. Disorienting and sobering at the same time. Like wait am I missing the boat? Wait—is there even a boat? Or are there five boats and no dock? Either way, this isn’t what I’m here for.

While “it’s the top” and other such bold, mostly unfounded claims can have some truth to them, here's what I've learned from months of stumbling through web3 (and life, really): the people who act like they know everything usually know the least.

The confidence required to risk actual money on digital tokens named after penguins? That doesn't come from understanding—it comes from accepting that you don't understand, but you're going to listen and research and ask questions and figure it the fuck out anyway. Also, sometimes there’s no figuring it out. You just feel something in your gut, take aim, and double backflip off the cliff. See what shakes out.

Does any of this mean I'm good at trading? Absolutely fucking not. Does it mean I'm learning to trust my instincts while simultaneously learning when not to trust them? I think so.

What I'm actually learning (besides how to gain or lose money efficiently)

This is the part that chokes me up. Because it’s tied to that family shit I mentioned earlier. You know, the financial illiteracy that gets passed down through generations, until someone says enough, there’s got to be a better way.

Here’s that Farcaster post I referenced…

I’m not crying you’re crying

The real education isn't in the trading—it's in realizing that financial literacy isn't some innate talent that other people have and you don't. It's a skill you build by doing uncomfortable things repeatedly until they become slightly less uncomfortable.

The idea of setting my first limit order felt like taking on quantum physics. Actually doing it felt like ordering coffee. The math still confuses me, but that’s ok. I don’t need to understand it all. With numbers (or whatever the fuck makes you black out whenever you’re around it), it’s about working with the confusion instead of being frozen by it.

Most importantly: you don't have to be good at numbers to be good at crypto.

You don’t even have to be or know everything, or even anything, to get started. You just have to be good at learning from mistakes and comfortable with looking stupid while you figure things out.

Which imo, is a life well lived anyway.

That's it for issue 28 of Babe—a love letter to limit orders and breaking generational traumas and the beauty of profitable confusion. I’m hoping next week’s issue will get into The Base App, but I still need some time with the thing before I can begin to write anything useful or insightful about it. So we’ll see.

Thanks for joining the chaos. Until next week, nerds.

xoxo,

lw

PS: Subscribe now if you want in on this arithmetic. Miss the last issue? It’s right here. Also literally none of this is ever financial advice. I’m sharing what I learn through Babe, and perhaps you’ll learn from my mistakes. Hopefully, maybe, who knows, ily.

Next week in Babe: Most likely intel and insights on that new-new Base App.